TL;DR

(TOO LONG, DIDN’T READ)

PROFIT ISN'T CASH: Many builders see strong profits on paper but still struggle with cash flow because profit (an accounting measure) doesn't equal available cash in the bank. This "illusion of profitability" can lead to poor financial decisions, especially during growth.

GROWTH EXPOSES WEAKNESSES: Scaling your business amplifies any existing inefficiencies in areas like bidding, job costing, or contract management, turning small leaks into major cash drains.

SPOT HIDDEN CASH TRAPS: Inaccurate bidding, mismanaged change orders, slow collections, and unaddressed retainage are common culprits that silently bleed your business of essential cash.

FORECASTING IS FREEDOM: You don't need complex tools to start. Basic, regular cash flow forecasting provides crucial visibility into future income and expenses, helping you anticipate and manage shortfalls.

TABLE OF CONTENTS

At GO First Consulting, we help remodelers and builders move beyond frustration and implement proactive, strategic approaches to estimates and sales. This article provides a playbook packed with creative and unconventional sales strategies specifically tailored to help you find and keep the projects your business depends on.

Ever look at a profit and loss statement that’s painting a pretty rosy picture, only to turn around and find yourself scrambling to cover payroll or that big materials invoice? If that sounds familiar, you're not alone. It’s one of the biggest (and most stressful) disconnects growing builders face.

You’re winning projects, things seem to be going well, but the bank account tells a different story. What gives?

THE DANGEROUS TRAP:

WHY SO MANY “PROFITABLE” BUILDERS ARE ACTUALLY CASH-POOR

Here’s the hard truth most builders learn the tough way: Profit is NOT the same as Cash in the Bank.

Your P&L shows accounting profit – a calculation of revenue minus expenses over a period. It’s an important number, for sure. But it doesn't tell you what’s actually available to spend right now. That’s your cash flow.

This "illusion of profitability" is a dangerous trap. You see strong profits on paper and feel confident about taking on more projects, hiring more crew, or buying that new piece of equipment. But if the cash isn't there to back those decisions, you can quickly run into serious trouble.

And guess what? Growth actually pours fuel on this fire. As you take on more (and bigger) projects, the demand for working capital skyrockets. Small inefficiencies that were manageable before suddenly become gaping holes draining your cash.

So, how do you escape this cycle and build a business that’s not just profitable on paper, but financially strong and resilient?

3 CRITICAL SHIFTS TO BRIDGE THE PROFIT-CASH GAP

It’s about making some fundamental shifts in how you see and manage your money.

SHIFT #1: DEMAND REAL VISIBILITY – KNOW YOUR ACTUAL CASH POSITION, NOT JUST YOUR “PROFIT”

THE CHANGE: You need to get crystal clear on the difference between accrual accounting (which is what your P&L likely uses) and your actual cash reality. Accrual accounting recognizes revenue when it's earned and expenses when they're incurred, not necessarily when money changes hands. For example, you might recognize revenue on a project that's 70% complete, boosting your "profit," but if the client hasn't paid that invoice yet, the cash isn't in your account.

📐 QUICK START: This week, pull up your latest Profit & Loss statement alongside your Statement of Cash Flows (if you have one) or even just your bank statements for the same period. On your P&L, look for non-cash items like depreciation. Now, compare the "net profit" to the actual change in your bank balance. That gap? That’s the profit-cash difference in action.

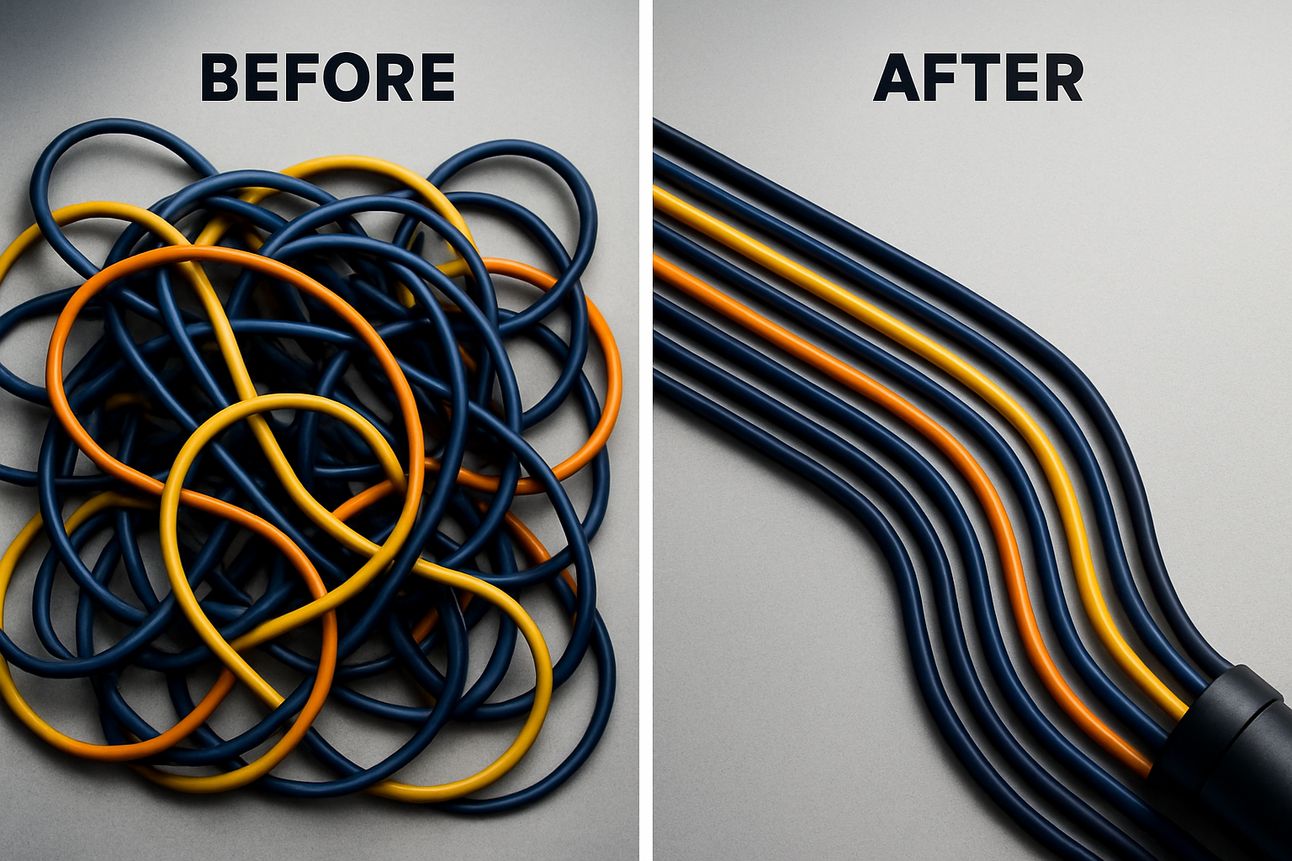

A simple seesaw graphic. One side, labeled "Profit," is high up in the air. The other side, labeled "Cash in Bank," is on the ground. Caption: "Are Your Profits Grounded in Cash Reality?"

SHIFT #2: BECOME A CASH DETECTIVE – SPOT THE HIDDEN DRAINS BEFORE THEY SINK YOU

THE CHANGE: For growing builders, cash doesn't just disappear; it leaks out through common cracks in your operations. Think inaccurate bids that don’t cover true costs, job costing that isn’t really telling you if a project is making money, or change orders that you do the work for but don’t get paid for promptly (or at all!). Retainage can also tie up significant cash.

📐 QUICK START: Grab the file for ONE recently completed project. Go through every change order. Ask yourself: Was this priced to cover ALL associated costs (direct, indirect, and margin)? Was it signed off by the client before we started the extra work? How long after completing the change order work did it take to get paid for it? Every "no" or "too long" is a cash leak.

A leaky pipe with drops of water turning into dollar signs. Each leak is labeled with a common issue: "Underbidding," "Slow Collections," "Unpaid Change Orders," "Retainage."

SHIFT #3: LOOK AHEAD – MAKE BASIC CASH FLOW FORECASTING YOUR SECRET WEAPON

THE CHANGE: You don’t need a crystal ball or a complicated financial model to get started. Basic cash flow forecasting is simply about looking ahead – anticipating what cash is coming IN and what cash needs to go OUT over the next few weeks or months. This visibility allows you to spot potential shortfalls before they happen, giving you time to react.

📐 QUICK START: Open a simple spreadsheet. Create two columns: "Cash In" and "Cash Out." For the next FOUR weeks, list all the project payments you realistically expect to receive each week in the "Cash In" column. In the "Cash Out" column, list all your committed payments for each week – payroll, supplier bills, subcontractor payments, loan payments, rent, etc. Subtract total outs from total ins for each week. This simple exercise, updated weekly, is the foundation of powerful cash management.

A QUICK WIN:

YOUR 5-MINUTE CASH REALITY CHECK

Want an instant snapshot? Do this right now:

What’s your current actual bank balance?

What are the ABSOLUTELY ESSENTIAL payments you must make in the next 7 days (payroll, critical supplier, subs)?

Is there a comfortable buffer between #1 and #2?

This simple check gets you thinking with a cash-first mindset.

THE BOTTOM LINE:

TAKE CONTROL OF YOUR CASH, TAKE CONTROL OF YOUR GROWTH

Moving from being "profit-rich but cash-poor" to having a strong, predictable cash position is fundamental to scaling your construction business sustainably. It’s about building the financial shock absorbers that let you handle the bumps in the road and confidently seize new opportunities.

P.S. Tired of the cash flow rollercoaster and the constant worry about meeting financial obligations? The GO First FrameWork™ is designed to help you install the robust systems you need – from more accurate estimating and job costing (part of our Sales Ops and Project Mgmt systems) to better financial visibility – so you can achieve predictable profitability and scale with confidence.

Ready to stop guessing and start knowing your cash position? Book Your FREE Assessment Today!